Disclosure

Law: Top States |

| 1. California |

Grade: A |

| 2. Oregon |

Grade: A |

| 3. Washington |

Grade: A- |

Most

Improved Since 2003 |

1.

Tennessee

2.

Vermont

3. Iowa

4. Oregon

5. South Carolina |

|

The

Campaign Disclosure Law category has been

the states’ best area of performance

in each of the five Grading State Disclosure

assessments. Just five states failed the law

assessment in 2008, down from twelve in 2003.

Forty-five states passed the law assessment

in 2008, including Utah, which earned its first

passing law grade this year. Seven states earned

grades in the A range in 2008, and 16 Bs, 17

Cs, five Ds, and five Fs round out the law

category grades.

Three

states made changes to their campaign laws

in 2007 that had a small impact on their

grades or ranks in the 2008 assessment, which

studied law changes made as of December 31,

2007. Utah improved from an F to a D- and West

Virginia moved from a C to a C+ with new laws

to improve disclosure. South Dakota, which

passed legislation in 2007 to require independent

expenditure disclosure and strengthen reporting

and enforcement provisions, moved up in the

law rankings but failed to earn a passing grade.

Additionally, a handful of states’ grades

in this category were revised after Project

researchers re-evaluated disclosure law findings

previously reported.

States with the strongest disclosure laws,

in rank order from one to ten, are: California;

Oregon; Washington; Virginia; Colorado, Hawaii

and Missouri (tied for 5th); Georgia and New

Jersey (tied for 8th); and Montana.

States

with the weakest disclosure laws, in rank order

from 41 to 50, and all earning Ds or Fs, are:

Delaware; Kansas; New Mexico; Maryland and

Utah (tied for 44th); South Dakota; Nevada;

Wyoming; Alabama; and North Dakota.

Significant 2008 findings:

- 50

states require campaign contributions to

be disclosed;

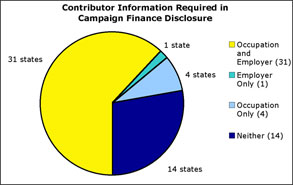

- 31

states require a contributor’s

occupation and employer to be disclosed;

- 4

states require a contributor’s

occupation, but not employer, to

be disclosed;

- 1

state (Rhode Island) requires a contributor’s

employer, but not occupation, to

be disclosed;

- 14 states do not require disclosure of

either occupation or employer;

- 49 states require campaign expenditures

to be disclosed (North Dakota does not);

- 24 states require expenditures made by

subvendors, such as credit card companies

to be reported;

- 44 states require independent expenditures

to be reported;

- 27 states require timely reporting of last-minute

independent expenditures;

- 36 states require timely reporting of last-minute

contributions;

- 33

states require either reviews of disclosure

reports or field audits of campaign records;

and

- 9 states require both reviews and field

audits of campaign records.

Significant changes since 2007:

- 1 state added independent expenditure reporting

requirements (South Dakota);

- 1 state added civil penalties for late

contribution reporting (South Dakota);

- 1 state added loan reporting requirements

(South Dakota);

- 1 state added a non-election year campaign

finance disclosure filing (Utah);

- 1 state added subvendor reporting requirements

(West Virginia); and

- 1

state removed the requirement to disclose

a contributor’s employer information

(South Dakota).

The Grading State Disclosure criteria evaluates

states in three major areas of their disclosure

laws: the amount of detail included in candidate

campaign finance reports; the timelines for

the report filing schedule; and the enforcement

provisions in place to ensure compliance with

the law.

Contributor Information

All

50 states require campaigns to disclose

the names of their contributors at varying

contribution thresholds, often with additional

details disclosed for larger contributions.

Thirty-two states require campaigns to disclose

their contributors’ employers, and all

but one of these states (Rhode Island) also

require the disclosure of their contributors’ occupations.

Four states (Florida, Indiana, Kansas, and

New Mexico) require the disclosure of occupation

but not employer data, though Kansas passed

legislation in 2008 requiring that a contributor’s

industry also be reported. Fourteen states

do not require the disclosure of either occupation

or employer data. South Dakota is among these

states and is also the only state that does

not require campaigns to report the date a

contribution is received.

click

image to enlarge

The

study also assesses whether the states require

campaigns to report the cumulative amount

donated by a contributor over the course

of a year or an election cycle. Such cumulative

data makes it easier for the public to identify

the scope of a donor’s contributions

to a specific candidate. Currently, 36 states

require campaigns to report a contributor’s

cumulative donations and 14 states do not.

In-Kind Contributions and Loans

All

50 states require campaigns to report in-kind

(non-monetary goods or services) contributions.

Loan disclosure is also common in the states,

with 49 states requiring some amount of loan

details to be reported (North Dakota does not).

Of the states that require loan reporting,

only South Dakota does not require disclosure

of the date the loan was received. Just 16

states require the interest rate of a loan

to a candidate to be disclosed, and 17 require

the repayment schedule to be reported. Thirty-five

states require candidates to disclose the guarantor

of their loans.

Expenditures

- North Dakota is the only state

that does not require that expenditures

be disclosed.

- Oklahoma and South Dakota do

not require the name or identity

of the recipient to be reported.

- Mississippi does not require

the purpose for a campaign expense

to be reported.

- California and South Dakota do

not require the date of expenditures

to be disclosed.

|

|

Forty-nine

states require that candidates disclose how

they spend campaign funds. Only North Dakota’s

law does not require campaign expenditure

disclosure. Of the 49 states that require

disclosure of campaign expenditures, Oklahoma

and South Dakota do not require the name

or identity of the recipient to be reported,

Mississippi does not require the purpose

for a campaign expense to be reported, and

only California and South Dakota do not require

the date of expenditures to be disclosed.

Forty-three states require candidates to

report accrued campaign debts and obligations.

Itemized subvendor expenses allow the public

to view the actual expenses made by campaigns,

rather than the name of a credit card company,

or a consultant hired to make purchases (media,

polling, etc.) on behalf of the campaign.

Itemization of subvendor expenses is mandatory

in 24 states, including West Virginia, which

added this provision in 2007.

Independent Expenditures

Independent

expenditures can be a major source of spending

in state elections. For example, a 2008 study

by California’s Fair Political Practices

Commission found that independent groups

have spent $100 million since 2001, when

the state’s campaign finance limits

took effect. Such expenditures are

made by individuals, corporations, unions,

and others operating independently from candidates,

sometimes in order to evade campaign contribution

limits.

Alabama,

Indiana, Maryland, New Mexico,

North Dakota, and Wyoming do

not require independent expenditure

reporting. |

|

With

legislation passed by South Dakota in 2007,

44 states now mandate the disclosure of independent

expenditures, 38 of which require reports to

specify which candidate is the

subject of the expenditure. Independent expenditures

made at the last minute are not as widely

reported, with just 27 states requiring such

disclosure. Alabama, Indiana, Maryland, New

Mexico, North Dakota, and Wyoming do not

require independent expenditure reporting.

Number of Reports Filed by Candidates

All

states set reporting periods within which

campaigns must account for their finances.

This study assesses state requirements for

pre-election reports, last-minute contribution

reports, and non-election year reports. In

election years, twelve states require one

pre-election report, 21 states require two

such reports, and 17 require three or more

reports before an election. (Oregon is included

among these 17 states as candidates file

reports on an ongoing basis.) Pre-election

reports are typically filed within a few

weeks of Election Day, leaving the states

to set additional requirements for contributions

that are received by campaigns in the closing

days of a campaign. Currently, 36 states

require pre-election disclosure of last-minute

contributions, while 14 states’ laws

do not, thus depriving the public of knowing

who a candidate’s last minute donors

are until after the election.

In non-election years, 27 states require two

or more disclosure reports to be filed. Twenty-three

states require one campaign disclosure report

to be filed, including Utah, which added this

requirement in 2007.

Auditing and Enforcement

Both

reviews and audits of disclosure

reports are required in California,

Florida, Idaho, Kentucky, Louisiana,

Minnesota, Nebraska, Oregon, and

Tennessee. |

|

Accepting

campaign finance reports and ensuring the accurate,

timely filing of those reports is the role

of state disclosure agencies. All 50 states

have some form of penalty (civil, criminal,

or both) triggered by a violation of campaign

disclosure requirements. However, the ability

to identify campaign finance violations varies

widely from state to state. To ensure the greatest

level of compliance, mandatory reviews of reports

filed at the disclosure agency would be followed

by field audits of campaigns’ records,

though just nine states require such a dual

program (California, Florida, Idaho, Kentucky,

Louisiana, Minnesota, Nebraska, Oregon, and

Tennessee). In total, 30 states require desk

reviews and twelve require field audits, while

17 states do not require either.

|