|

For the fourth year in a row, states across

the country performed best in the Campaign

Disclosure Law category, with only six states

receiving F grades. Four states made improvements

to their campaign disclosure laws since the

2005 study, with Oregon and Virginia moving

into the A range, and Tennessee and Vermont

moving up into the C range from a D- and an

F, respectively. Six states received law grades

in the A range, and there were 16 grades in

the B range in this category. Four Ds and 18

Cs account for the remaining Disclosure Law

grades.

- States

with the strongest disclosure laws, in rank

order from one to ten, are: California; Oregon;

Washington; Virginia; Colorado and Hawaii

(tied for 5th); Georgia and New Jersey (tied

for 7th); Montana; Missouri, Kentucky and

Minnesota (tied for 10th).

- States

with the weakest disclosure laws, in rank

order from 41 to 50, are: Delaware; Kansas;

New Mexico; Maryland; Utah; Nevada; Wyoming;

Alabama; South Dakota; and North Dakota.

Significant 2007 findings:

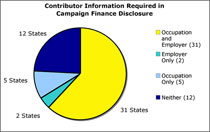

- 31

states require a contributor’s

occupation and employer to be disclosed;

- 5

states require only a contributor’s

occupation to be disclosed;

- 2

states require only a contributor’s

employer to be disclosed;

- 12

states do not require disclosure of either

occupation or employer;

- 48

states require descriptions of expenditures

to be disclosed;

- 21

states require expenditures made by subvendors

to be reported;

- 42

states require independent expenditures

to be reported;

- 26

states require timely reporting of last-minute

independent expenditures;

- 36

states require timely reporting of last-minute

contributions;

- 30

states conduct mandatory reviews of disclosure

reports;

- 12

states require field audits of disclosure

reports; and

- 9

states require both desk reviews and field

audits of campaign filings.

Significant changes since 2005:

- 2

states increased the number of pre-election

reports that must be filed by candidates

(Oregon, Tennessee);

- 2

states added an additional non-election

year campaign finance disclosure filing

(Oregon, Tennessee);

- 1

state added contributor occupation and

employer reporting (Tennessee);

- 1

state added timely reporting of last-minute

contributions (Vermont);

- 1

state added subvendor reporting requirements

(Tennessee);

- 1

state added independent expenditure reporting

requirements (Vermont); and

- 2

states added timely reporting of last-minute

independent expenditures (Vermont and Virginia).

Four

states earned higher grades in the Disclosure

Law category following improvements made to

their campaign disclosure laws as of December

31, 2006 (the cutoff period for disclosure

law changes to be reflected in Grading State

Disclosure 2007). Oregon and Tennessee improved

both in pre-election reporting and non-election

year reporting, while Tennessee also added

subvendor reporting requirements. Vermont added

independent expenditure reporting and improved

its reporting of last-minute contributions,

while Virginia strengthened its already strong

disclosure law by requiring more thorough independent

expenditure reporting. Additionally, a number

of states’ grades in this category were

revised after Project researchers re-evaluated

disclosure law findings previously reported.

Many

states that strengthen their campaign disclosure

laws do so through the appointment of a task

force or panel to study the issues that are

clouding the public’s ability

to access campaign finance information. Tennessee’s

Citizen Advisory Group on Ethics and Oregon’s

Campaign Finance Disclosure Panel are just

two examples of state initiatives that led

to successful changes in campaign disclosure

laws. Task forces can add weight to recommended

reforms and provide greater momentum for passage,

particularly with the appointment of a diverse,

bi-partisan panel that includes both citizens

and policymakers.

Contributor Information

As

in years past, Grading State Disclosure 2007

found that every state requires campaign

contributors to be named at some contribution

threshold, often with additional details disclosed

for larger contributions. South Dakota remains

the only state that does not require the date

of contributions to be disclosed, but is among

the 33 states that require a contributor’s

employer to be disclosed. Thirty-six states

require the disclosure of a contributor’s

occupation, while 31 states require both occupation

and employer information to be listed on disclosure

reports. Twelve states require neither occupation

nor employer information to be disclosed.

click

image to enlarge

The

final detail examined in this study regarding

contributor information is whether or not a

state requires the cumulative contributions

made by a donor over the course of a year or

election cycle to be reported. Cumulative contribution

data makes it easier for the public to identify

the scope of a donor’s contributions

to a specific candidate. Thirty-six states

require cumulative contributions to be reported;

14 states do not.

In-Kind Contributions and Loans

All

states require in-kind contributions to be

reported, and 48 states require some amount

of loan details to be disclosed. Only 15 states

require the interest rate of a loan to a candidate

to be disclosed, and 16 require the repayment

schedule to be reported. In 35 states, the

loan’s guarantor must be included in

the candidate’s campaign disclosure reports,

rather than simply naming the financial institution

making the loan.

Expenditures

Forty-nine states mandate that candidates

report their campaign expenses. North Dakota

remains the only state that does not require

disclosure of campaign expenses. Oklahoma and

South Dakota require the amount of an expenditure

to be disclosed, but not the name or identity

of the recipient. Mississippi does not require

the purpose for a campaign expense to be reported.

Forty-seven states require the date of campaign

expenses to be disclosed, and 42 states require

candidates to report their campaign debts and

obligations. Only 21 states require the disclosure

of subvendor payments, such as the itemization

of expenses made by campaign consultants or

a detailed accounting of credit card expenses.

Number of Reports Filed

States

vary widely in the frequency of disclosure

reports required to be filed. In election years,

twelve states require one pre-election report,

21 states require two such reports, and 17

require three or more reports before an election.

In non-election years, 23 states require one

report, while 27 states require two or more.

Disclosure of late contributions (made between

the close of the final pre-election reporting

period and Election Day) is required in 36

states. In the 14 states without such last-minute

reporting, many contributions are hidden from

public review until after the election has

taken place.

Independent Expenditures

In recent years, increased attention has been

paid to expenditures made by committees that

operate independently from candidates and spend

tremendous amounts of money to affect election

outcomes. Individuals, corporations, unions,

and others seeking to influence the outcome

of elections can do so through independent

expenditures, thus evading state or federal

contribution limits. As the prominence of independent

expenditures has grown, states have taken steps

to ensure that the public knows who is behind

this unlimited campaign spending.

Forty-two states now require independent expenditure

reporting and 36 of those states require independent

expenditure reports to specify which candidate

is the subject of the expense. Twenty-six of

these states also require that last-minute

independent expenditures be reported before

the election. As of December 31, 2006, eight

states -- Alabama, Indiana, Maryland, New Mexico,

North Dakota, South Dakota, Tennessee and Wyoming

-- did not require independent expenditure

reporting (South Dakota enacted this requirement

in 2007).

Auditing and Enforcement

As important as campaign disclosures are,

it is equally important to ensure that disclosure

reports are accurately filed in a timely fashion.

All 50 states have some form of penalty (civil

or criminal) triggered by a violation of campaign

disclosure requirements. However, the mechanisms

for identifying those violations vary from

state to state. Ideally, all states would conduct

both mandatory reviews as well as field audits

of campaign finance records. Presently, 30

states conduct desk reviews and twelve states

conduct field audits, with just nine states

requiring both (California, Florida, Idaho,

Kentucky, Louisiana, Minnesota, Nebraska, Oregon

and Tennessee). Seventeen states have no provisions

for auditing campaign finances.

|